The Benefits of Using a Monoline Lender vs. a Bank: Understanding Pre-Payment Penalties

When it comes to choosing a mortgage, many homebuyers focus solely on the interest rate, often overlooking other crucial factors like pre-payment penalties. This can be a costly mistake. Today, we’ll explore the benefits of using a monoline lender—available exclusively through mortgage brokers—versus a traditional bank, particularly in the context of pre-payment penalties. We’ll also discuss how taking the lower rate upfront might not always be the best decision in the long run.

What Are Pre-Payment Penalties?

Pre-payment penalties are fees charged by lenders when you pay off your mortgage early, either through refinancing or by selling your home. These penalties are designed to compensate the lender for the interest they would have earned if the mortgage had remained in place for the full term.

Monoline Lenders vs. Banks: A Comparison

**Monoline Lenders**

– **Specialization**: Monoline lenders specialize exclusively in mortgages, which often allows them to offer more flexible and borrower-friendly terms.

– **Pre-Payment Penalties**: Generally, monoline lenders have more lenient pre-payment penalty structures. They often use a three-month interest penalty or an Interest Rate Differential (IRD) calculation that is more transparent and fair to the borrower.

– **Customization**: Since monoline lenders are focused on mortgages, they can tailor products to better suit individual needs, including more flexible pre-payment options.

**Banks**

– **Range of Products**: Banks offer a wide range of financial products, not just mortgages. This can be beneficial if you want to consolidate your banking needs, but it can also mean that mortgage terms are less flexible.

– **Pre-Payment Penalties**: Banks often have stricter pre-payment penalties. Their IRD calculations can be more complex and less favorable to borrowers, potentially resulting in higher costs if you need to break your mortgage early.

– **Lower Initial Rates**: Banks sometimes offer lower initial rates, but this can be misleading if it leads to higher costs down the road due to strict pre-payment penalties.

The True Cost of Lower Rates

Taking a lower rate upfront can be tempting, but it’s crucial to consider the potential long-term implications:

- **Breaking Your Mortgage**: Life is unpredictable. You might need to break your mortgage due to job relocation, a growing family, or financial changes. If your mortgage is with a bank that has high pre-payment penalties, the cost of breaking your mortgage can outweigh the savings from the lower initial rate.

- **Interest Rate Differential (IRD)**: Banks often use a more complex and less transparent IRD calculation for pre-payment penalties, which can result in unexpectedly high costs. Monoline lenders typically offer more straightforward and fairer IRD calculations, making it easier to understand and predict your penalties.

- **Flexibility and Options**: Monoline lenders generally provide more flexible options for pre-payments, such as lump-sum payments or increasing regular payments without penalties. This flexibility can help you pay off your mortgage faster and save on interest, which might not be possible with a bank mortgage.

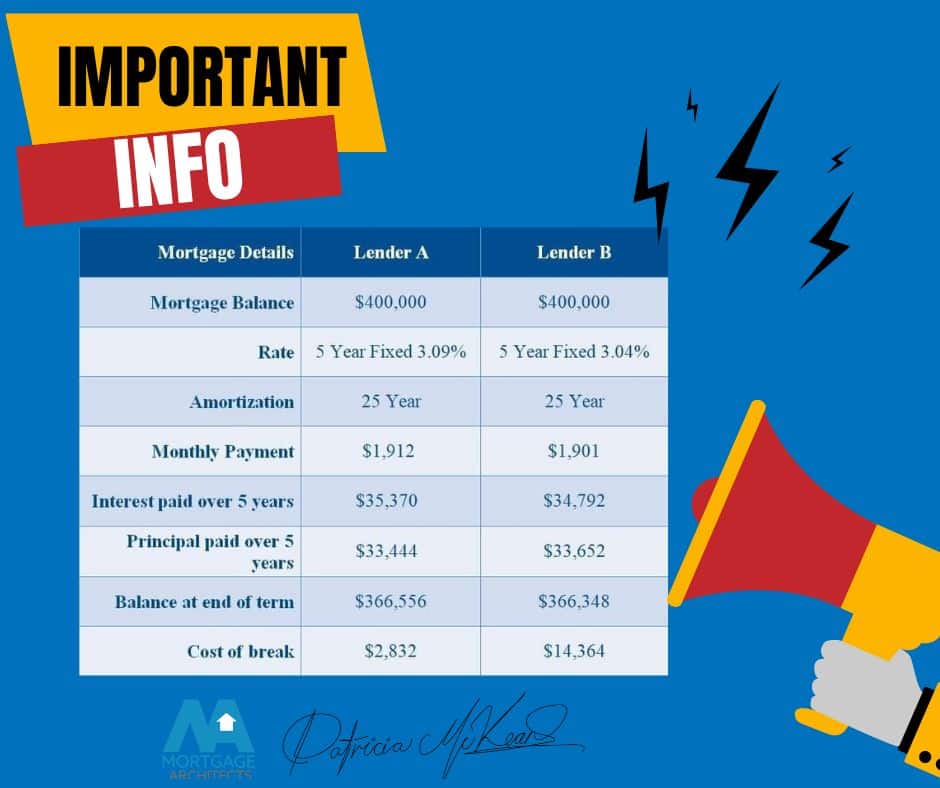

Case Study: Comparing Costs

Imagine two scenarios:

– **Scenario A**: You choose a bank mortgage with a slightly lower rate but stricter pre-payment penalties.

– **Scenario B**: You choose a monoline lender with a slightly higher rate but more lenient pre-payment penalties.

If you need to break your mortgage after three years, the pre-payment penalty with the bank could be significantly higher due to their IRD calculation. This could negate any savings from the lower initial rate. In contrast, the monoline lender’s fairer penalty structure might result in lower overall costs, even with a slightly higher interest rate.

When choosing a mortgage, it’s essential to look beyond the initial interest rate and consider the full picture, including pre-payment penalties. Monoline lenders, accessible only through mortgage brokers, often provide more borrower-friendly terms and flexibility, which can save you money in the long run. By understanding the potential pitfalls of lower upfront rates and strict pre-payment penalties, you can make a more informed decision that aligns with your financial goals and life plans.

Remember, working with a knowledgeable mortgage broker can help you navigate these complexities and find the best mortgage solution for your unique situation. Give me a call and I will walk you through the process and ensure you fully understand the product you are receiving 403-875-2969.

Remember when you hear “Mortgages” think “Patricia”