The 5 C's of credit and how to better understand to get a mortgage approval

When you’re applying for a loan, whether it’s for a new car, a home, or to start a business, lenders don’t just look at your credit score and call it a day. They use a comprehensive evaluation method known as the 5 C’s of Credit to determine your risk as a borrower. This method provides a well-rounded picture of your financial health and reliability. By understanding the 5 C’s—Character, Capacity, Capital, Collateral, and Conditions—you can better prepare yourself for the loan application process and improve your chances of securing the funds you need. In this blog post, we’ll dive into each of these criteria, explaining what they mean, how lenders assess them, and what you can do to make yourself a more attractive candidate for credit.

1. Character

Lenders need to get a sense of who they are lending to, so it’s crucial that the application is filled out thoroughly and accurately. By understanding your client’s background, we can build a complete picture of their situation.

Some questions to ask your client:

- What is your marital status (e.g., married, common law, divorced/separated)?

- Are there support payments involved?

- Are they working their way out of a difficult financial situation after a major life event?

By showcasing pride of ownership or a history of responsible financial behavior, you’re helping the lender see the character behind the numbers.

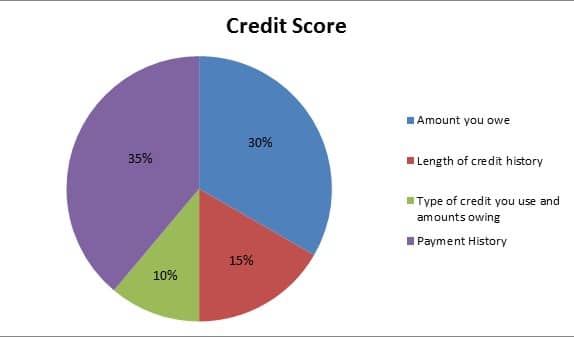

2. Credit

Everyone faces challenges, and significant life events can impact credit. However, transparency is key. The more we know, the better we can position the client for approval.

Ask questions like:

- Have you ever filed for bankruptcy or a consumer proposal?

- Was there a foreclosure, and are you now discharged?

- What’s the current balance owing, and is anything registered on the title?

Explain any isolated credit issues. If a client has faced financial hardship due to injury or a death in the family, that context can make a difference in how the underwriter views their application.

3. Collateral

The property itself is a big part of the loan decision. Lenders want to know that the asset backing the mortgage is sound.

Ask:

- What condition is the property in, and when was it built?

- Is any work in progress or is anything in need of replacement?

- Are there any unique factors (e.g., near train tracks, environmental protected areas)?

Providing a detailed understanding of the property ensures that the collateral aspect is solid.

4. Capital

Clients need to show that they have the financial resources to make a down payment and cover closing costs.

Questions to ask:

- What savings or assets does the client have?

- Are there any other funds they can tap into?

This helps demonstrate that the client is financially prepared to make the purchase.

5. Capacity

Capacity is about whether the client can afford the mortgage based on their income and debt obligations.

Key questions to explore:

- What are their sources of income (employment, investments, etc.)?

- Do they have any existing debt obligations?

We want to make sure that their debt-to-income ratio shows they can handle the mortgage payments comfortably.

By taking the time to explore these areas with your clients, we can ensure the mortgage application stands out to lenders as well-rounded and reliable. Each of these factors contributes to the overall story, so being thorough in how we approach them is critical for approval.

Remember, working with a knowledgeable mortgage broker can help you navigate these complexities and find the best mortgage solution for your unique situation. Give me a call and I will walk you through the process and ensure you fully understand the product you are receiving 403-875-2969.

Remember when you hear “Mortgages” think “Patricia”